In the complex world of insurance, particularly general liability insurance, the role of an insurance broker can be crucial. Whether you're a business owner, an entrepreneur, or just someone looking to safeguard their assets, understanding why to use an insurance broker can significantly impact your decision-making process. This article delves into the benefits of working with an insurance broker and how they can assist you in navigating the intricacies of general liability insurance.

Understanding General Liability Insurance

General liability insurance is designed to protect businesses from various risks and potential lawsuits. It covers claims related to bodily injury, property damage, personal injury, and advertising injury that may arise from business operations. For many businesses, having this coverage is essential to ensure financial stability and legal compliance.

However, selecting the right policy and understanding the nuances of coverage can be challenging. This is where an insurance broker comes into play.

The Role of an Insurance Broker

An insurance broker acts as an intermediary between you and insurance providers. Unlike insurance agents who work for a specific insurance company, brokers represent you, the client. Their primary role is to understand your needs, assess the risks associated with your business, and find the most suitable insurance policy from a range of options.

Expertise and Knowledge

Insurance brokers possess specialized knowledge and expertise in the insurance industry. They stay updated with the latest industry trends, regulatory changes, and insurance products. This expertise allows them to provide valuable insights and recommendations tailored to your specific needs.

When it comes to general liability insurance, brokers can help you understand the various policy options, coverage limits, and exclusions. They can explain complex terms and conditions in a way that is easy to understand, ensuring you make informed decisions.

Tailored Insurance Solutions

Every business is unique, and so are its insurance needs. A one-size-fits-all approach does not work when it comes to general liability insurance. Insurance brokers assess the specific risks associated with your business and tailor insurance solutions accordingly.

For example, a construction company may face different risks compared to a retail business. Brokers can help customize your policy to address the unique challenges of your industry, ensuring that you have adequate coverage for potential liabilities.

Access to a Wide Range of Insurers

Insurance brokers have access to a broad network of insurance providers. This access allows them to compare policies from different insurers and find the best coverage at competitive rates. Brokers can leverage their relationships with insurers to negotiate favorable terms and pricing on your behalf.

Instead of contacting multiple insurance companies individually, you can rely on a broker to streamline the process. They will gather quotes, evaluate options, and present you with the most suitable choices based on your needs and budget.

Assistance with Claims

In the unfortunate event that you need to file a claim, insurance brokers can be a valuable resource. They assist with the claims process, ensuring that you provide all necessary documentation and information to support your claim. Brokers act as your advocate, working with the insurance company to facilitate a smooth and timely resolution.

Their involvement can help reduce the stress and complexity associated with filing a claim. They ensure that you receive the compensation you are entitled to under your policy, minimizing disruptions to your business operations.

Compliance and Risk Management

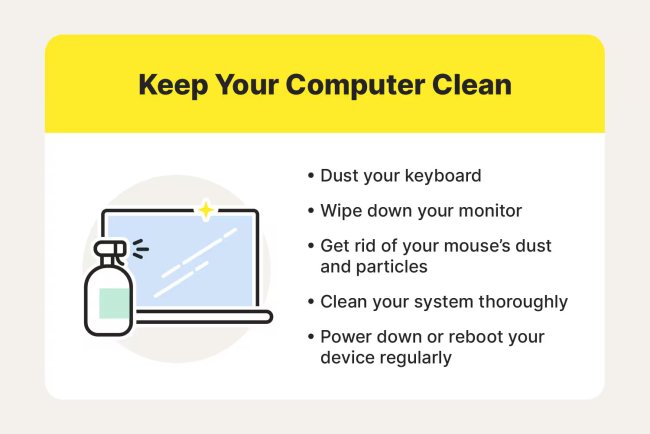

Staying compliant with insurance regulations and managing risks effectively are crucial aspects of running a business. Insurance brokers help ensure that your general liability insurance policy meets legal requirements and industry standards.

Additionally, brokers can offer risk management advice to help you mitigate potential risks and reduce the likelihood of claims. They can recommend best practices and safety measures to enhance your business's overall risk profile.

Cost Savings and Efficiency

While it may seem counterintuitive, using an insurance broker can actually lead to cost savings in the long run. Brokers help you find the most cost-effective insurance solutions without compromising on coverage quality. Their ability to negotiate favorable terms and access to competitive rates can result in lower premiums for your general liability insurance.

Moreover, brokers can save you time and effort by handling the complexities of the insurance process. Instead of spending hours researching and comparing policies, you can rely on a broker to do the legwork for you. This efficiency allows you to focus on running your business while ensuring that your insurance needs are met.

Building Long-Term Relationships

Insurance brokers aim to build long-term relationships with their clients. They take the time to understand your business, its evolving needs, and any changes in your risk profile. This ongoing relationship ensures that your insurance coverage remains relevant and adequate as your business grows and evolves.

Brokers can provide periodic reviews of your policy to ensure it continues to meet your needs. They offer ongoing support and guidance, helping you navigate any changes in the insurance landscape or your business operations.

Using an insurance broker can offer significant advantages when it comes to managing general liability insurance. Their expertise, access to multiple insurers, and tailored solutions ensure that you receive the best coverage for your specific needs. Brokers streamline the insurance process, assist with claims, and provide valuable risk management advice. By leveraging their services, you can achieve cost savings, efficiency, and peace of mind, allowing you to focus on what matters most—running and growing your business.